Are We in Trouble? Analyzing the United States Economy

As of November 14th, 2022, we sit at a frightening 7.75 percent inflation, gas prices have risen over 50 percent since the beginning of this year, and the Dow Jones has fallen 18 percent year to date. The reality we face looks grim, but are we truly facing a financial crisis? To answer this question, there are three important factors to consider: first, the conflict between Russia and Ukraine; second, the Federal Reserve’s handling of inflation; and third, the United States’ fossil fuel dilemma, which will all lead to an increased chance of a financial crisis.

The conflict between Russia and Ukraine has prompted President Biden to issue economic sanctions on Russia, which has initiated an all-out “economic war.” On March 8, Biden signed an executive order to ban the domestic import of Russian oil, liquefied natural gas, and coal, in turn also banning new U.S. investment into Russia’s energy sector. However, this policy has caused plenty of strife in the United States economy, less so than our European counterparts. American dependence on Russian oil is lower than other countries such as France, Germany, and most of the EU. However, the most significant impact is instilling doubt in the stock market and economic investments. Before the war between Russia and Ukraine, the stock market was still a respectable, although rocky, form of investment that many were eager to jump aboard on. The war in Ukraine has completely changed this; since financial institutions and investors have begun to doubt the strength of the markets and even though the American financial markets remain stable in the short term, lack of confidence will spur heightened volatility and eventually a recession. The war between Russia and Ukraine has fostered significant impacts both throughout the globe and within our domestic financial markets.

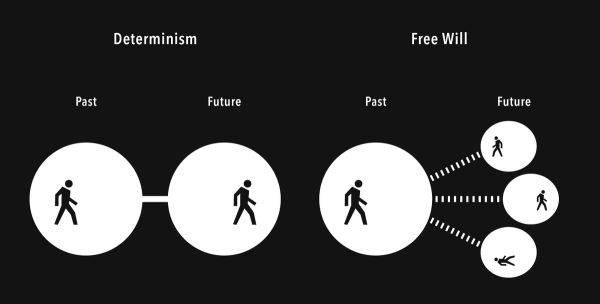

Although the war in Ukraine has had a damaging effect on the economy, politicians across the aisle have blamed the Federal Reserve, especially its chair Jerome Powell. Vermont Senator Bernie Sanders, a former presidential candidate, said of the Reserve last month “I think they’re hurting the situation. It is wrong to be saying that the way we’re going to deal with inflation is by lowering wages and increasing unemployment.” From Sanders’ progressive point of view, the Federal Reserve’s actions are damaging to the middle class. He views the lowering of wages as a direct correlation with the increasing rates of unemployment. On the other hand, ranking Republican Senator Pat Toomey offered criticism for what he views as the Fed’s inaction on inflation. “The Fed’s policy is especially troubling because the warning siren for problematic inflation is getting louder. Inflation is here, and it’s more severe than most—including the Fed itself—expected.” His belief in the Federal Reserve’s inaction and lack of swift action, although opposite from Senator Sanders’ point of view, still points the finger at the Federal Reserve. So, is it truly the fault of the Federal Reserve and Chairman Powell? Based on their current actions, it seems so. The Federal Reserve has increased interest rates and printed more money, which has led to uncontrolled inflation. Although this measure was initially used to combat inflation, the increase in interest rates has caused doubt in the financial markets eventually causing inflation. These combined factors can be used to attribute the possibility of an economic crisis to the federal reserve.

The aforementioned war in Russia and Ukraine, although not as detrimental to the United States oil supply, has triggered a much more devastating side effect. The Organization of the Petroleum Exporting Countries (OPEC) just endorsed a cut to its output target to the United States this month after the White House exchanged words with Saudi Arabia, due to their involvement with Russia. This all ties back to the conflict in Ukraine as the White House has attributed this cut to Saudi Arabia’s relationship with the Russian government. American National Security Council spokesman, John Kirby, said that this move would boost Russia’s foreign earnings and suggested it had been engineered by Saudi Arabia for political reasons. The lack of oil will further drive up gas prices, which is one of the qualifications for a financial crisis. The oil crisis that is about to hit our nation is something that we should be wary of as it is another sign of the tumultuous times to come.

Analyzing the combined factors of the conflict between Russia and Ukraine, the Federal Reserve’s indecisive actions, and the oil crisis our nation is about to face; a financial crisis looks like it will occur in the coming months.

Sources:

Dallas Fed:

https://www.dallasfed.org/research/economics/2022/0517.aspx

Politico:

https://www.politico.com/news/2022/10/11/jerome-powell-risking-recession-to-beat-inflation-00061003

Investopedia:

https://www.investopedia.com/terms/r/recession.asp

The New Yorker

JP Morgan Chase

https://www.jpmorgan.com/insights/research/russia-ukraine-crisis-market-impact

Reuters

Reuters

Grade: 11

Years on Staff: 1

Why are you writing for the Flintridge Press?

I believe that sharing topics regarding politics and the economy can...